In the dynamic landscape of entrepreneurial endeavors, the acquisition of a business loan holds the potential to be a transformative force. As financial architects, entrepreneurs must comprehend the intricate dance between business loans and personal credit, where each step echoes through the corridors of creditworthiness.

Introduction

Embarking on this financial journey requires an understanding of the fundamental nature of business loans. These financial instruments, often the lifeblood of burgeoning enterprises, warrant a closer examination of their impact on personal credit landscapes.

Importance of Understanding Business Loans

Business loans, in essence, act as catalysts for entrepreneurial growth. The strategic utilization of these financial resources underscores the importance of sound financial management, a linchpin in the success of any business venture.

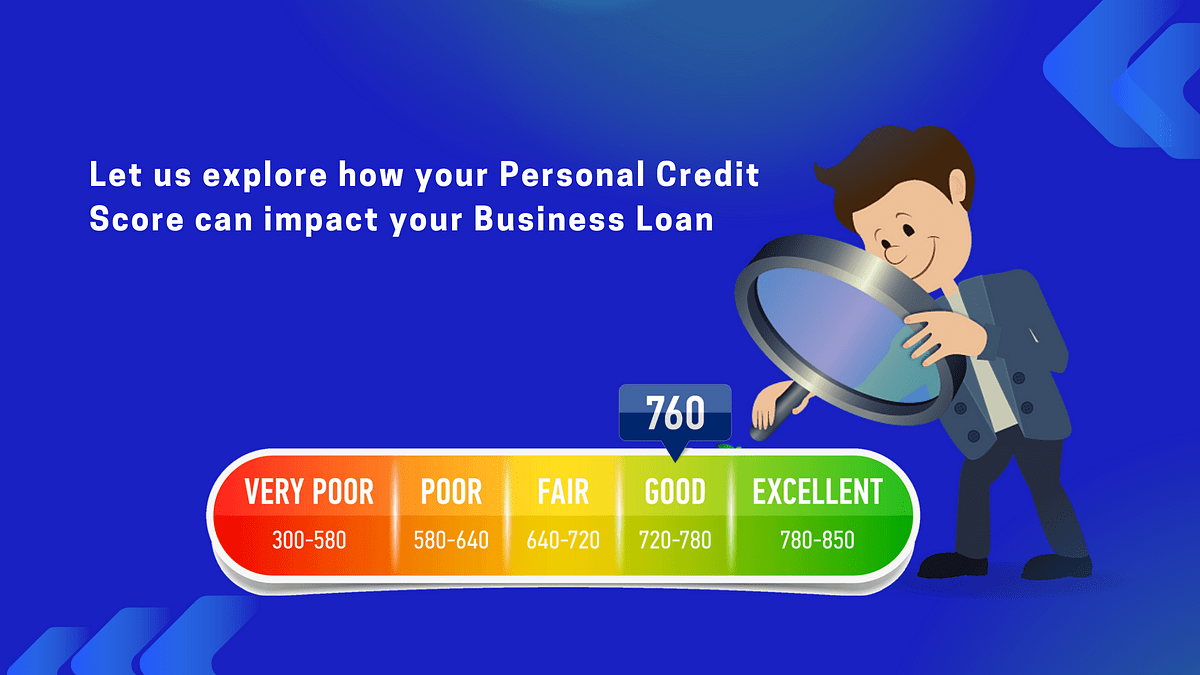

The Nexus Between Business Loans and Personal Credit

Establishing a nexus between business loans and personal credit is paramount. The intricate connections forged through financial transactions can significantly influence one’s creditworthiness.

Positive Impacts of Business Loans on Personal Credit

When approached with sagacity, business loans have the power to elevate personal credit standing. The responsible stewardship of financial resources paints a portrait of fiscal responsibility, enhancing creditworthiness.

Risks and Negative Impacts

However, the pendulum swings both ways. Mismanagement of business loan affairs can unfurl a tableau of financial woes, casting a shadow on personal credit landscapes. It is within the realm of fiscal responsibility that the impact of a business loan on personal credit unfolds.

The Dual Nature of Risk and Reward

In navigating the intricate pathways of business financing, entrepreneurs are tasked with a delicate balancing act. A judiciously utilized business loan can transmute risk into an asset, burnishing the sheen of personal credit portfolios.

Navigating the Landscape of Credit Reporting

Credit reporting serves as the canvas upon which the impact of business loans is painted. Astute financial maneuvers can orchestrate a harmonious tune, resonating positively through the echelons of credit assessments.

Strategic Credit Utilization

The prudent allocation of business loan proceeds is akin to a deft brushstroke on the canvas of credit management. When coupled with strategic intent, this maneuver shapes a positive narrative within credit portfolios.

The Impact of Fiscal Responsibility in Entrepreneurship

The relationship between business loans and personal credit is symbiotic. Credit becomes a reflection of financial acumen, intertwining with the successes and challenges of entrepreneurial pursuits.

Nuanced Credit Utilization Strategies

The strategic allocation of funds, guided by calculated risk profiles, becomes imperative. Mitigating adverse impacts on personal credit requires nuanced strategies that align with financial objectives.

Orchestrating a Harmonious Credit Symphony

Masterstrokes in credit reporting are akin to a symphony, where each note contributes to a positive resonance in credit assessments. The narrative arc extends beyond binary outcomes, embracing nuanced perspectives on credit impact.

Double-Edged Sword of Indiscriminate Fund Usage

Indiscriminate use of business loan funds, divorced from strategic intent, transforms the financial elixir into a potent concoction of fiscal pitfalls. The negative repercussions etch a less-than-rosy narrative on the canvas of credit history.

The Narrative Arc of Positive and Negative Impact

The impact of a business loan on personal credit transcends binary realms. It weaves a narrative that reflects the dual nature of risk and reward, where every financial decision becomes a pivotal chapter in the credit story.

Strategic Allocation of Business Loan Proceeds

Defining strategic intent becomes the compass guiding entrepreneurs through the labyrinth of business financing. The delicate balance of risk and reward shapes the narrative arc, determining the impact on personal credit.

Conclusion

In conclusion, the impact of a business loan on personal credit is a dynamic interplay of financial decisions. The symbiotic relationship requires entrepreneurs to tread with sagacity, utilizing business loans as tools for growth while safeguarding personal creditworthiness.

- How does a business loan positively impact personal credit?

- Responsible financial stewardship and strategic utilization enhance credit standing.

- What are the risks of mismanaging business loan affairs?

- Mismanagement can lead to financial woes, casting a shadow on personal credit.

- How does credit reporting shape the impact of business loans?

- Astute financial maneuvers in credit reporting orchestrate a positive resonance.

- What is the significance of strategic credit utilization?

- Prudent allocation of funds shapes a positive narrative within credit portfolios.

- How can entrepreneurs navigate the dual nature of risk and reward in business financing?

- A delicate balancing act is required, transmuting risk into an asset for personal credit portfolios.

2 thoughts on “Impact of a business loan on personal credit”

Comments are closed.