When you buy a home with a mortgage, you don’t just pay back the amount you borrowed, known as the principal. You also pay mortgage interest on the loan amount you haven’t yet repaid. This is the cost of borrowing money. How much you will pay in mortgage interest varies depending on factors like the type, size, and duration of your loan, as well as the size of your down payment.

Typically, a bank or mortgage lender will finance 80% or more of the price of the home, and you agree to pay it back—with interest—over a specific period. As you compare lenders, mortgage rates, and loan options, it’s helpful to understand how mortgages work and which kind may be best for you.

Mortgage Interest vs. Principal

Each mortgage payment you make will have two parts. The principal is the borrowed amount you haven’t yet paid back. The interest is the cost of borrowing that money. Mortgage interest is calculated as a percentage of the remaining principal.

With most mortgages, you pay back a portion of the amount you borrowed (the principal) plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each monthly payment into principal and interest.1

When you first start making mortgage payments, you will likely pay more each month in interest than you do on the loan’s principal. But, as you make payments, the principal you haven’t repaid decreases. This means that the interest you pay each month will also decrease, allowing more and more of your mortgage payment to go towards repaying the principal.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much you’ll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because you’ll be paying interest for a longer period.

Fixed-Rate Interest vs. Adjustable-Rate Interest

Lenders set your interest rate based on various factors that reflect how risky they think it is to loan you money. For example, you will likely be offered a higher interest rate if you have a lot of other debt, an irregular income, or a low credit score. This means that the cost of borrowing money to buy a house is higher.

You are more likely to be offered a lower interest rate if you have a high credit score, few or no other debts, and reliable income. This means that the overall cost of your mortgage will be lower.

Your mortgage interest rate is also impacted by the type of mortgage you get. Banks and lenders primarily offer two basic types of loans:

- Fixed-rate: The interest rate is set when you take out the mortgage and does not change.

- Adjustable rate: The interest rate you start with will change under defined conditions (also called a variable rate or hybrid loan).2

Here’s how the two types work.

Fixed-Rate Mortgages

With this type of mortgage, the interest rate is locked in for the life of the loan and does not change. The monthly payment also remains the same for the life of the loan.2 Loans often have a repayment life span of 30 years, although shorter lengths of 10, 15, or 20 years are also widely available. Shorter loans require larger monthly payments but have lower total interest costs.

Example: A $200,000 fixed-rate mortgage for 30 years (360 monthly payments) at an annual interest rate of 4.5% will have a monthly payment of approximately $1,013. (Real-estate taxes, private mortgage insurance, and homeowners insurance are additional and not included in this figure.) The 4.5% annual interest rate translates into a monthly interest rate of 0.375% (4.5% divided by 12). So, you’ll pay 0.375% interest each month on your outstanding loan balance.

When you make your first payment of $1,013, the bank will apply $750 to the loan’s interest and $263 to the principal. Because the principal is a little smaller, the second monthly payment will accrue a little less interest, so slightly more of the principal will be paid off. By the 359th payment, almost the whole monthly payment will apply to the principal.

Adjustable-Rate Mortgages (ARMs)

Because the interest rate on an adjustable-rate mortgage is not permanently locked in, the monthly payment will change over the life of the loan.3 Most ARMs have limits or caps on how much the interest rate can fluctuate, how often it can be changed, and how high it can go. When the rate goes up or down, the lender recalculates your monthly payment, which will then remain stable until the next rate adjustment occurs.

As with a fixed-rate mortgage, when the lender receives your monthly payment, it will apply a portion to interest and another portion to the principal.

Lenders often offer lower interest rates for the first few years of an ARM, sometimes called teaser rates, but these can change after that—as often as once a year. The initial interest rate for an ARM tends to be significantly lower than that of a fixed-rate mortgage. Therefore, ARMs can be attractive if you plan to stay in your home for only a few years.

If you’re considering an ARM, find out how its interest rate is determined; many are tied to a certain index, such as the rate on one-year U.S. Treasury bills, plus a certain additional percentage or margin. Also, ask how often the interest rate will adjust. For example, a five-to-one-year ARM has a fixed rate for five years. After that, the interest rate will adjust each year for the remainder of the loan period.

Example: A $200,000 five-to-one-year adjustable-rate mortgage for 30 years (360 monthly payments) might start with an annual interest rate of 4% for five years, after which the rate is allowed to change by as much as 0.25% every year. The payment amount for months 1 through 60 would be $955 per month. If it then rises by 0.25%, the payment for months 61 through 72 would be $980, and the payment for months 73 through 84 would be $1,005. (Again, taxes and insurance are not included in these figures.)

Interest-Only Mortgages

A much rarer third option is an interest-only mortgage. This is usually reserved for wealthy homebuyers or buyers with irregular incomes.

As the name implies, this type of loan allows you to pay only interest for the first few years, resulting in lower monthly payments.4 It might be a reasonable choice if you expect to own the home for a relatively short time and intend to sell before the bigger monthly payments begin. However, you won’t build any equity in the home because you won’t own any more of it during the time you are only paying back interest. If your home declines in value, you could owe more than it is worth.

Jumbo Mortgage Loans

A jumbo mortgage is usually for amounts over the conforming loan limit. In 2024, this limit is $766,550 for most parts of the U.S., a $40,350 increase over the 2023 limit of $726,200. The 2024 maximum conforming loan limit is $1,149,825 for high-cost areas. This is 150 percent of $766,550 and an increase over the 2023 maximum limit of $1,089,300.56

Jumbo loans can be either fixed or adjustable. Their interest rates tend to be slightly higher than those on smaller loans of the same type.

Interest-only jumbo loans are also available, though usually only for the very wealthy. They are structured similarly to an ARM, and the interest-only period lasts as long as 10 years. After that, the rate adjusts annually, and payments go toward paying off the principal. Payments can go up significantly at that point.

What Interest Rate Will I Get When I Take out a Mortgage?

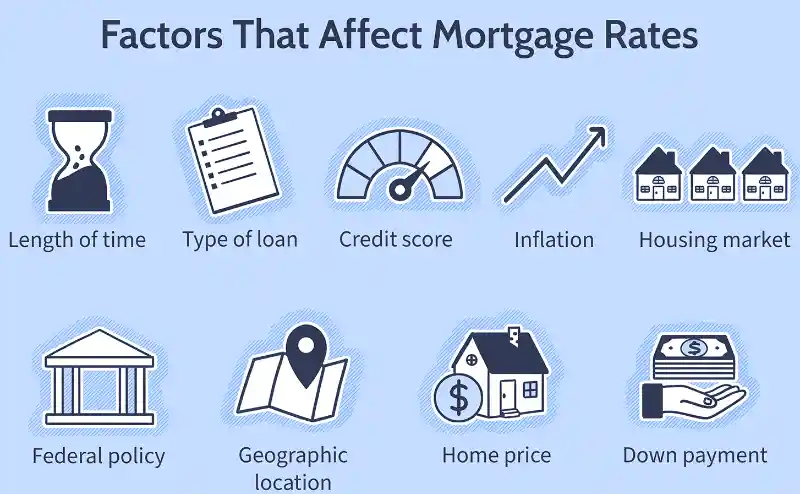

The interest rate you get on your mortgage depends on a variety of factors. The economic climate and interest rates set by the Federal Reserve impact mortgage rates, as do other things.

From there, lenders will calculate your interest rate based on your financial situation, including your credit score, any other debts you have, and your likelihood of defaulting on a loan. The less risky a lender thinks it is to lend your money, the lower your interest rate will be.

Why Is My Monthly Mortgage Payment Changing Even Though My Interest Rate Is Fixed?

Your lender may require you to pay your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time, which can cause your monthly payment to increase.

Why Is It Better to Have a Lower Interest Rate on My Mortgage?

Mortgage interest is additional money you pay to your lender on top of the money you borrowed to buy your house. Interest is charged as a percentage of the principal, or the amount you borrowed, and it is essentially the fee you pay to borrow the money in your mortgage. The lower your interest rate, the less interest you pay over time, and the less expensive it is to borrow the money in your mortgage.

The Bottom Line

When you have a mortgage, you are charged interest as a percentage of the principal you haven’t yet repaid to your lender. This interest is the cost of borrowing money for a mortgage.

There are two basic types of mortgages: fixed-rate, which means the interest rate stays the same, and adjustable-rate, which means the interest rate changes over time. Over time, the interest you need to repay each month decreases, and more of your mortgage payment goes toward paying off the principal. The interest rate you get will depend on a combination of interest rates set by the Federal Reserve and your personal finances.